|

露丝·兰多是纽约哥伦比亚大学医学中心的妇产科麻醉师。今年2月的一天,她正在查房的时候,接到了药剂师打来的一通令人不安的电话——药剂师说,医院里的丁哌卡因马上就要用完了。丁哌卡因是一种几乎每名产妇生产时都会用到的局部麻醉剂,它起效很快,药效可以预估,一直是该医院辅助分娩时的不二之选,一般用于自然分娩中的硬膜外麻醉,或是剖腹产时的脊椎麻醉。它通过葡萄糖溶液给药,在紧急分娩时是一种极其重要的药品。 “如果胎儿或者产妇情况不好,就必须分秒必争。”兰多表示:“目前,确实没有另一种麻醉剂的安全性和可靠性比得上丁哌卡因,所以大家才都在用它。”如果医院继续以目前的消耗速度使用丁哌卡因,那么库存的丁哌卡因最多三周内就会用完。而据这种药品的生产厂商辉瑞估计,下一批丁哌卡因估计得到6月才能上市。 作为一名从业20多年的产科麻醉师,兰多对各种暂时性的药品短缺早已见怪不怪了,但这么严重且事先没有任何警告的缺货却还是第一次。“丁哌卡因我们已经用了几十年了,我们非常清楚它如何给药、多长时间起效,闭着眼睛都不会出错。可是一夜之间,他们却跟我说,这种药没有了。”几天内,北美地区所有医院的麻醉师们几乎都在社交媒体上讨论这个问题,很多麻醉师不得不采取了风险较高的替代方案,比如给产妇上全身麻醉。不过北美的产科已经有几十年不这么做了。 在美国,这种短缺似乎让人难以理解,因为美国貌似是个在医疗开支上不遗余力的国家,2016年,美国的医疗支出达到了3.3万亿美元,而且美国也是在精准施药上走在最前面的国家。然而即便美国的医疗体系貌似极为强大,其漏洞却也有不少,丁哌卡因的短缺也并非孤例,反而是一种“新常态”。比如每家医院最常用的各种基本注射针剂,或多或少都处于捉襟见肘的状态。 |

This February Ruth Landau, an obstetric anesthesiologist at ?Columbia University Medical Center in New York City, was making rounds when she got a disturbing call from one of the hospital’s pharmacists. The center was due to run out of bupivacaine, a local anesthetic used in virtually every baby delivery. Fast-acting and predictable, the numbing agent has long been the drug of choice for supporting childbirth, administered as an epidural for women in labor or as a spinal anesthetic for those having a cesarean section. Prepared in a dextrose solution, the syrup-like injection is especially critical in emergency deliveries. “When the baby or mom is not doing well, every minute counts,” says Landau. “There really is no alternative that provides the same safety, reliability, and comfort that we all have using it.” If the hospital staff continued to use the drug at its usual rate, it would blow through the remaining supply in three weeks. The drug’s manufacturer, Pfizer, estimated the next delivery of the product would come in June. A 20-year veteran of her field, Landau had seen a variety of drug shortages come and go during her career, but nothing of this magnitude, and never with such little warning: “Suddenly, we’re being told this one drug—the one we’ve been using for decades, that we know best how to give, how fast it kicks in, we can do it with our eyes shut—suddenly, we’re being told we won’t have that drug.” Within days, anesthesiologists at hospitals across North America were conferring about the same problem over social media; many were throwing out short-term fixes that were risky in their own right—putting delivering mothers under general anesthesia, for example. Landau thought the field had moved past such practices decades ago. Such shortages may seem unfathomable in America where, when it comes to health care, we seemingly spare no expense—shelling out $3.3 trillion in 2016—and muse about the promising future of precision medicine. But even in our staggeringly costly and ambitious health care system, the bupivacaine shortage is not an outlier. Rather, it’s the new norm. Increasingly, the low-cost essential medicines that we’ve used for years—a category known as generic sterile injectable drugs, considered the “bread and butter” of hospital care—are in short supply. |

|

根据最近的统计,美国各大医院短缺的常用药品有202种,很多都是极为重要的基础药品,比如肾上腺素、吗啡、无菌水等等。在飓风“玛利亚”袭击了波多黎各后,美国连生理盐水的供应量都跌到了警戒线,因为它的主要生产商没法将产品和包装从波多黎各运到美国来。另一种药品碳酸氢钠主要用于心脏手术或用于肾衰竭患者,该药品去年也遭遇了严重的短缺。(好在碳酸氢钠可以从澳大利亚进口,多少缓解了一些用药荒,不过它直到现在仍然处于短缺状态。)此外,今年严重匮乏的还有各种阿片类针剂,它们可以用来控制重伤、手术和晚期病患的疼痛,因此它本应是医院和临终关怀机构的常备药品。 俄亥俄州代顿市的迈阿密山谷医院是美国一家顶级的创伤治疗医院,但急诊室的护士们现在经常拿不到一些急需的药物。比如由于缺乏一种叫昂丹司琼的抗恶心药物,医护人员只好拿另一种药品代替,但那种药品有比较严重的负作用,会刺激病人的血管。再比如用于治疗心动过速的地尔疏卓,由于这种药品迟迟得不到补充,医护人员只好拿另一种叫美托洛尔的药物来代替,但后者对于一些人并不安全。 “这种情况让我晚上睡不着觉……稍有不慎,一次急救就会变成一场灾难。” ——戴夫·哈洛:马丁医疗系统公司助理副总裁兼首席药品官 已经在医疗行业工作38年的凯伦·皮尔森认为:“我们是在开历史的倒车。”急诊医生兰迪·马里奥特表示,每当病人对他手头上仅有的药品过敏时,他只得进一步追问他们:你是真的过敏呢,还是只是有点敏感?“这太荒唐了。”他对《财富》表示:“这种对话其实并不罕见:‘你要不就用这种药物对付一下吧?它虽然负作用很严重,但多少能缓解你的痛苦,因为今天我没有别的药物能给你了。’” 药品短缺问题给美国大大小小的医院都带来了严峻的挑战。克里弗兰诊所(Cleveland Clinic)的资深药品短缺问题研究专家克里斯·斯奈德表示,目前的情况已经恶化到了无以复加的地步。作为美国最先进的医院之一,克里夫兰诊所每天都会遭遇药品短缺问题。美国药物安全实践研究所去年10月的一项调查显示,药品短缺使74%的医疗从业者无法为患者提供最推荐的药物,而且经常会导致延误治疗。路易斯安纳州奥克斯纳医疗系统(Ochsner Health System)的药品服务副总裁黛比·西蒙森表示:“能不能找到一种确保能治好病人的药物,已经成了我们的一大挑战。” 这些短缺的药品有一个共同点,它们几乎都是美国最大的制药公司辉瑞生产的(辉瑞排在今年《财富》美国500强排行榜的第57名)。辉瑞也是全球最大的针剂类药品生产商。不过到5月11日,辉瑞有370种产品断货或限量供应,辉瑞表示,其中的102种可能要到2019年才会有货。 美国为什么有这么多种针剂缺货?答案其实很简单,美国最大的针剂药品生产商不生产它们了。 2015年2月初,当辉瑞宣布有意以170亿美元收购世界领先的无菌注射药物生产商赫士睿时,华尔街一片欢呼雀跃。这笔交易达成的非常快,辉瑞CEO伊恩·里德在12月中旬联系了赫尔睿CEO迈克·鲍尔。在6天后的会面中,里德提出愿意以30%的溢价,也就是每股82美元的价格收购赫士睿。赫士睿公司经过一番讨价还价,在1月初将收购价抬到了每股90美元。两周后,双方就签订了最终的并购协议。 辉瑞公司在新闻通稿中明确表示,希望通过此次并购,尽快主宰通用无菌注射针剂市场。到2020年,该市场的全球销售额有望达到700亿美元。更引人注目的是,赫士睿本身就是生物仿制药市场的领先玩家。生物仿制药指的是大分子生物制剂在专利过期后的仿制药品。近几十年,这些大分子生物制剂的专利药品往往贵得令人咂舌,说是天价也不为过,仿制这些大分子生物制剂,要比仿制伟哥这种小分子药品困难得多。据辉瑞预测,过不了几年,生物仿制药市场就会扩张成一个200亿美元的大市场。而在2014年,赫士睿在通用注射针剂和生物仿制药市场的销售额总共只有30多亿美元。 早在这次收购之前,辉瑞CEO里德就想做一笔具有转型性质的大交易。他的公司在海外坐拥海量现金,当时在可见的未来里,美国对企业税改革的可能性并不大,因此很多人都认为,里德可能是想收购一家海外商业实体,搞一个当时比较时髦的“反向避税”,也就是重新注册到一个低企业税的国家。为此,辉瑞做了一次仓促的尝试,在2014年初企图以1180亿美元恶意收购英国制药商阿斯利康,但此次尝试最终以失败告终。两年后,辉瑞又企图以1600亿美元收购总部位于爱尔兰的制药公司艾尔健,但由于美国财政部改革了反向避税规则,最终辉瑞的这次尝试也再次告吹。 辉瑞不仅仅对躲避纳税义务感兴趣,它还想增长得更大——然后,它的最终目标是变得更小。这些年来,辉瑞曾多次谈及拆分成两个独立上市实体的想法,其中一个专门搞创新药物,另一个主要搞非专利药物、注射针剂、医疗耗材等传统业务。然而后来辉瑞却在2016年自行放弃了这个想法,这也让包括高盛分析师贾米·鲁宾在内的很多观察人士产生了辉瑞缺乏战略远见的印象。 鲁宾对《财富》表示:“过去三四年,他们都处在比较茫然的阶段,他们在财务增长手段基本用完了,增长程度也只是平平。” 至于辉瑞的常用药业务,其发展轨迹则更为糟糕。这个部门的运营成本比创新药部门还要高,2017年其销售额下跌了14亿美元,究其原因,应是受赫士睿业务所累。 赫士睿的英文名字“Hospira”是一个生造词,是由“hospital“(医院)、“inspire”(灵感)和“spero“(拉丁文的“希望”)三个单词各截取一部分拼成的。但是近些年来,这家公司确貌似毫无希望可言。它原本是雅培公司生产医疗产品的部门,2004年被剥离成一家单独的公司。随着设备日益老化,这家公司基本上是在苟延残喘地混日子。不过在经济危机期间,它积极发起了一项旨在提高公司效率的“燃料工程”,2011年一次性裁掉了1400名冗员(三年后补发了6000万美元的遣散费,但如此大幅的裁员,也影响了公司的产品质量,遣散了很多宝贵的技术工人)。 接下来发生的事情也就自然而然了,2009年至2015年间,该公司收到了8份美国食品药品监督管理局(FDA)的警告函,并有多批次的产品被召回。该公司的洛基山工厂曾被公司管理层自豪地称为“王冠上的明珠”,然后FDA的检查人员却给这颗“明珠”指出了一连串的问题,比如缺乏适当的测试和控制流程、人员培训不足、厂房与生产设备设计不佳等等。 2011年,赫士睿迎来了新的管理层。在公司的投资者日上,公司高级运营副总裁吉姆·哈迪对观众们说道:“让我们彼此坦承直言吧,我们都知道,我们有一些问题必须要解决。” 要解决这些问题并不容易。为了解决管理乱象,公司高层专门引进了一支团队。在他们看来,要想让洛基山工厂达到合格的水平,至少需要三年时间。有人甚至称这家工厂是“一场灾难”。由于需要测试的产品批次太多,公司只得额外租用仓库去存放它们。该公司召回的产品数量也越来越多,根据FDA的数据,从2012年到2015年,该公司总共召回了239批次的产品。它的无菌药剂里发现过各种各样的杂质,从人的头发到玻璃渣,再到“橙色不明颗粒物”无所不有。这些召回也给药品行业刊物增添了不少素材,他们也不遗余力地大肆报道该公司的每一次召回和整治行动。 尽管如此,赫士睿公司还是觉得自己有了些进步。他们引进了人才,整顿了工厂,也缓和了与FDA的关系。CEO迈克·鲍尔本人也经常去FDA开会。在收益电话会议上,鲍尔经常将公司的生产隐患比作“鳄鱼”。2014年2月,鲍尔曾表示公司的转型已经基本成功:“我不能说把所有的‘鳄鱼’都抓到了,但是我认为,我们已经把‘沼泽’抽干了。泥浆里可能还潜藏着一两只,但是我们基本上已经把它们都挖出来了。” 当辉瑞收购赫士睿时,管理层相信一切已经尽在掌控,收拾烂摊子的这支团队的核心成员也各回各家了。当辉瑞向赫士睿的业务进行投资时,它光在洛基山工厂就裁掉了几百名员工。 然而一连串的召回并未就此停止。自从2015年9月并购结束以来,至少又发生了45次召回。赫士睿在堪萨斯州的麦克弗森有一家生产了41年的工厂,它与洛基山工厂生产了美国大部分的注射针剂产品,然而政府检查人员对它的批评却越来越严厉。2016年6月,FDA向该工厂签发了一封“483”警告函,足足用了21页的篇幅批评这家工厂,内容包括该厂对投诉不够重视、没有开展适当调查,以及产品质量问题等等。 警告函中尤其提到,有医院投诉某一批次的杜丁胺“在一周后会迅速变成暗粉色”,或是一种“暗沉的香槟色”,有的还会变成“桃红色”,甚至里面还有“橡皮渣似的屑状物”。杜丁胺是一种强心剂,当然,它本应该是无色透明的。 麦克弗森工厂坐落于一座老旧的铁路小镇边上,8个月后的2017年2月,该工厂再次收到了FDA的警告函。 这封警告函一共2500余词,函中提到了方方面面的问题。尤其是函中提到,在某一批次的万古霉素针剂中发现了不明颗粒物。(经辉瑞公司后来检测,这种不明颗粒物是硬纸板的碎屑。)虽然投诉不断,但辉瑞在整整五个月里并未召回大量产品。FDA在警告函的结尾处毫不客气地给此事定了性:“数个工厂反复出现质量问题,表明你公司对药品生产的监管和控制是不力的。” 辉瑞公司生产了美国75%的阿片类注射针剂,其中大部分又是在麦克弗森工厂生产的。另外,美国的大量麻醉剂,包括前文中提到的产妇分娩时要用的丁哌卡因,也都是在这里生产的。 在哥伦比亚大学医疗中心,兰多和她的同事们制定了一些节约措施,好让有限的丁哌卡因能多用几个月。丁哌卡因是一种局部麻醉药品,医院的各个科室和各种手术都用得到,但根据最新规定,哥大医院只有风险最高、最复杂的紧急分娩情形才能使用它。而全国范围内,各大医院也在纷纷推广兰多等人制定的节约措施。比如丁哌卡因原本是一小瓶专供一个病人的,用剩下的就会被处理掉。而现在它在备药时则会被分成多支针剂,好多给几个病人用。 供给短缺这四个字听起来似乎属于上个时代,又像是一个用来形容社会主义经济功能失调的名词,然而事实上,多年来,短缺在美国也一直是一个顽疾。近十年来,美国遭遇的供给短缺不胜枚举。根据最具权威的犹他大学短缺药品名录显示,2011年,美国最新短缺的药品达到了创纪录的257种,与此同时,持续短缺的药品也达到184种。就此事,美国国会召开了多次听证会,政府问责局也写了一系列报告。这些短缺充分暴露了美国医疗系统供应链的脆弱,甚至早就已经处于崩溃的边缘。 最容易出现短缺的药物都有一些共同点——它们一般是非专利药品,产量较大,生产利润很低,对于生产商来说没什么赚头,比不上那些对企业盈亏意义重大的先进的专利药。因此,对于这些我们使用最多但利润最薄的基础药物,逐利的企业自然是没有太多兴趣的。 美国国会在2012年通过立法手段,要求药品生产商在预见会出现供给短缺问题时,要提前给出更多通知。然而这一解决方案似乎并未抓住重点——重点是市场失灵了,原因可以归结为缺乏经济激励。 对于药品生产厂商来说,他们从这些被大量使用的廉价药中赚不到多少利润,因为它们的药价主要由厂商和团购组织通过谈判商定,这些团购组织存在的意义就是为了让医院能拿到低价药。这样一来,常用廉价药就成了一场薄利多销的游戏,促进了市场固化。另外,制药行业又是个严监管、高成本的市场,被挤出行业的企业也不在少数。同时,这也使企业更不愿意追加投资,或是为供应链建立冗余。反正就算供给短缺了,对药品生产商的经济影响也是暂时的,而且影响有限。另外由于行业参与者太少,客户本身也没什么选择。结果就是整个体系拿着将将够用的库存得过且过,只要不出什么意外,就混一天算一天。 然而去年却出了不少意外。 |

As of last count, there were 202 medicines on the drug shortage list. They include a bafflingly wide array of medical staples such as epinephrine, morphine, and sterile water. Already in short supply, the nation’s stocks of saline—the saltwater solution used to administer other drugs through IV lines—fell perilously low after Hurricane Maria crippled its main manufacturer’s ability to get product and empty bags out of Puerto Rico. Sodium bicarbonate, another indispensable product—essentially baking soda in solution—that is used in heart surgeries and for kidney-failure patients, was likewise in critical shortage last summer. (Australian imports have helped, but the product remains on the shortage list today.) This year hospitals are struggling to get injectable opiates, which hospitals and hospices use to manage the pain of serious injury, surgery, and terminal disease. In Ohio, at Dayton’s Miami Valley Hospital, a top-tier trauma center, ER nurses can’t get their hands on medicines they’ve used for years. They’re short of ondansetron, a first-line anti-nausea medication, for which they’ve had to substitute another drug that can cause side effects and irritate some patients’ veins. There isn’t any diltiazem, a one-time staple to treat rapid heart rate. (The drug doctors now use instead—metoprolol—isn’t safe for some people.) “This is what keeps me up at night… the situation is an emergency waiting to be a disaster.” ——Dave Harlow: Assistant Vice President and Chief Pharmacy Officer, Martin Health System “We’ve stepped back in time,” says Karen Pearson, who has worked on the ward for 38 years. When patients say they have allergies to the only available drugs, Randy Marriott, an emergency physician, now feels he has to press them: Is this a true allergy or just a sensitivity? “It’s ridiculous,” he tells Fortune. “This is not an infrequent conversation I have. ‘Can I give you this drug that will give you miserable side effects to relieve your pain? Because today I don’t have another drug to give you.’” The problem is testing health care networks, large and small. Chris Snyder, Cleveland Clinic’s seasoned drug shortage specialist, says the situation is as bad as it has ever been; on average, a shortage crops up at the state-of-the-art system every weekday. According to an October survey from the Institute for Safe Medication Practices, shortages have prevented 71% of practitioners from providing recommended drugs or treatment and frequently delay care. “Our primary responsibility is taking care of patients,” fumes Debbie Simonson, VP of pharmacy services at Ochsner Health System in Louisiana. “That becomes a challenge when we’re making sure we can get a drug to take care of them.” There’s another thing these drugs have in common, though. They’re almost all produced by America’s largest pharmaceutical company, Pfizer (No. 57 on this year’s Fortune 500). Indeed, as of May 11, the company, which is also the world’s largest maker of sterile injectable drugs, had 370 products that are depleted or in limited supply, 102 of which the company has indicated will not be available until 2019. The simple answer to why America currently has so many shortages of generic sterile injectable drugs: America’s leading manufacturer of generic sterile injectable drugs hasn’t been ?making them. Wall Street cheered when Pfizer announced its intention to buy Hospira, the world’s leading maker of generic sterile injectable drugs, for $17 billion, in early February 2015. The deal had been done after a hasty courtship—Pfizer CEO Ian Read reached out to Hospira chief Mike Ball in mid-December, and at a meeting six days later, Read offered to buy the company at a 30% premium, or $82 per share. By mid-January the Chicago-area Hospira had negotiated it up to $90. Two weeks later the parties had signed a definitive merger agreement. Pfizer’s press release made clear its hopes of soon dominating the generic sterile injectable drugs market, a segment where global sales were projected to reach $70 billion by 2020. Perhaps even more tantalizing, Hospira was a leading player in the fledgling biosimilar market. Biosimilars are essentially generic versions of large-molecule “biologics,” the often phenomenally expensive medicines that have dominated drug development in recent decades. They’re much harder to copy than small-molecule drugs like Viagra. Pfizer forecast that would be a $20 billion market in a handful of years. Hospira’s combined net sales in these two categories in 2014 were just over $3 billion. Pfizer CEO Read had been looking to make a transformative deal. His company was sitting on a pile of cash overseas, and with no corporate tax reform in sight, many suspected Read’s master plan was to buy an overseas entity that would allow the pharma company to, as was fashionable at the time, “invert”—or reincorporate in that lower-tax country. The company made one brash but failed attempt, with a hostile takeover of British drugmaker AstraZeneca, offering to pay $118 billion in early 2014. Two years later Pfizer walked away from a $160 billion deal with Ireland–headquartered Allergan after the Treasury Department changed the rules on tax inversions. Pfizer wasn’t just interested in paring its tax liability. It wanted to get bigger—and then, ultimately, get smaller. The company had long talked of splitting itself into two separately traded units—one that focused on innovative new medicines and the other on medical basics like generics, injectables, and hospital staples. But they backed away from that idea as well in 2016, leaving many observers, including Goldman Sachsanalyst Jami Rubin, with the impression that Pfizer—Big Pharma’s symbolic leader—was strategically at sea. “The last three or four years they’ve been in limbo,” Rubin tells Fortune. “They’ve run out of financial engineering options. Their growth has been pretty flatline.” As for Pfizer’s pharmaceutical staples business, the trajectory has been worse. The division, which is oddly more costly to operate than its drug innovation unit, recorded a $1.4 billion decline in sales in 2017, dragged down primarily by the legacy Hospira business. The name “Hospira” had been cobbled together, according to the company, from the words “hospital,” “inspire,” and “spero,” the Latin word for hope. But for years the business had looked hopeless. Once the hospital products division of Abbott Laboratories, it had been spun off in 2004. With aging facilities, the sterile drugmaker muddled along, and then in the depths of the recession, launched an aggressive efficiency initiative dubbed “Project Fuel.” Fourteen hundred jobs were shed as part of the exercise. According to former employees and a shareholder suit filed in 2011 (and settled three years later for $60 million), the cuts gutted the company’s quality and technical staff. What followed is not terribly surprising: Between 2009 and 2015, the company received eight FDA warning letters and announced a steady drumbeat of recalls. At Rocky Mount, the North Carolina plant that management called the company’s “crown jewel,” FDA inspectors took issue with a comprehensive array of problems, from a lack of proper testing and control procedures to inadequate training of employees to poor design of buildings and manufacturing equipment. By 2011, Hospira had new management, and at the company’s investor day, they offered some straight talk. “Let’s just be real with each other,” senior VP of operations Jim Hardy told the audience. “We understand we have issues to fix.” Fixing them wasn’t easy though. To the team management brought in to clean up the mess, it became clear that getting Rocky Mount alone up to snuff was at least a three-year job. One described the plant as “a disaster.” It had so many batches awaiting testing that the company needed to lease additional warehouse space to store them. Recalls proliferated—the company tallied 239 recalls between 2012 and the start of 2015, according to FDA data—with sterile products already in the marketplace being found to contain everything from human hair to glass to “orange particulate matter.” The saga served as relatively titillating fare for the pharmaceutical trade press, which followed the company’s every recall and disciplinary action with gusto. Still those at Hospira felt they were getting somewhere. They had brought in talent, made improvements to plants, and thawed relations with the FDA; CEO Mike Ballhimself regularly showed up for meetings with the agency. In earnings calls, Ball often referred to the company’s manufacturing woes as “gators,” and when asked by an analyst for a “Gator update” in February 2014, the executive declared something akin to mission accomplished: “I never say never in terms of gators, but I think we’ve got the swamp drained. There might be one or two hiding deep in the mud, but I think we’ve pretty much dug them out.” When Pfizer bought the company, management was confident it had things under control. Key members of Hospira’s cleanup crew were let go. While Pfizer made some investments, it also laid off hundreds of workers at Rocky Mount alone. The string of recalls didn’t stop, however; there have been at least 45 more since the sale went through in September 2015. Hospira’s 41-year-old facility in McPherson, Kans.—which, together with Rocky Mount, produced the bulk of America’s sterile injectable drug supply—drew increasingly harsh reviews from government inspectors. In June 2016 the FDA issued a “483” for the site—a post-inspection memo—that was 21 pages of biting criticism. It chronicled instances of complaints that had been inadequately investigated and product that looked, well, not like you’d want your sterile injectable drugs to look. As to one particular batch of dobutamine, a drug that helps the heart pump blood, hospitals had complained that the medicine, typically clear, “rapidly changed?…?to a dark pink color after a week”—or it was “a dingy champagne color,” or it was “peachy-colored” with “little flakes, like eraser dust.” The McPherson site, which sits at the periphery of an old railroad town, got an FDA warning letter eight months later, in February 2017. The comprehensive 2,500-word document took issue with a gamut of things—and recounted an incident in which the plant received a complaint about particulate matter found in an injection of the antibiotic vancomycin. (Pfizer itself later assessed it to be cardboard.) Despite additional complaints, Pfizer hadn’t recalled the lot of not-so-sterile product for five months. The FDA’s letter ended with a flourish of sweeping condemnation: “Repeated failures at multiple sites demonstrate that your company’s oversight and control over the manufacture of drugs is inadequate.” The McPherson plant is where Pfizer, which makes 75% of America’s injectable opioids, produces most of those drugs. It’s also the production site for a major share of the nation’s anesthetics, including bupivacaine—the drug Columbia anesthesiologist Ruth Landau administers to delivering mothers every day. At Columbia, Landau and her colleagues have established conservation measures to make a limited supply last for months. Though bupivacaine is used as a local anesthetic across the hospital, for all sorts of procedures, Columbia now reserves the dextrose preparation for the most risky and complicated of emergency deliveries. And hospitals nationwide, using guidance Landau helped develop, now prepare multiple doses from a vial that would normally be used on one patient. Shortages may sound like a problem from a bygone era or a dysfunctional facet of socialist economies, but they’ve been a stubborn problem in the U.S. for years. The country experienced a rash of them at the start of the decade. In 2011, a then-record 257 medications were added to the University of Utah’s authoritative shortage list, joining the 184 medicines that were already in short supply. That prompted congressional hearings and a series of reports from the Government Accountability Office. The shortages exposed the fragility of the American health care supply chain, which, as many in the system will tell you, has long been on the verge of buckling. The medications most vulnerable to running short have a few things in common: They are generic, high-volume, and low-margin for their makers—not the cutting-edge specialty drugs that pad pharmaceutical companies’ bottom lines. Companies have little incentive to make the workhorse drugs we use most. Congress’s response was to pass legislation in 2012, requiring manufacturers to give more notice ahead of anticipated shortages—but that seems to miss the point: What we’ve been witnessing, in slow motion, is market failure. It boils down to a lack of economic incentives. Manufacturers of widely used, inexpensive drugs make relatively little off the products, whose prices are largely determined in contract negotiations between drugmakers and group purchasing organizations (or GPOs), which exist to broker better deals for hospitals. That makes this a high-volume, low-cost game, a reality that has driven consolidation in the market. It’s also a highly regulated and somewhat costly industry, which has chased some companies out. The economics make it hard to invest in the business or in building supply chain redundancy. When shortages happen, the financial losses tend to be marginal and temporary; there are too few players for customers to take their business elsewhere. What’s left is a system with just enough inventory to get by if nothing goes wrong. Last year, a lot went wrong. |

|

去年9月,飓风“玛利亚”严重损毁了波多黎各的电网,由此带来的蝴蝶效应影响了整个美国的医疗系统,它甚至让我们每个人都处于极其脆弱的境地。美国进口的很多药物和生理盐水都是波多黎各生产的。美国卫生与人力资源部应急准备和响应副部长办公室的一位官员表示:“很多时候,短缺的药品并没有理想的替代品,或者很难找到替代品,现在这种短缺的情况越来越多,导致了一连串雪崩似的短缺。”负责统计犹他大学短缺药品名录的专家艾琳·福克斯指出,在“玛利亚”风灾之后,先是小袋的生理盐水开始短缺,随后大袋生理盐水以及注射器、药瓶和无菌水等都开始短缺了。 除了天灾,还有辉瑞的“人祸”。 从2017年春天开始,辉瑞时不时就会发布以“亲爱的客户”开头的信件,无一例外都是提醒客户可能出现供给短缺——短缺的原因则是麦克弗森工厂出了问题。短缺最严重的,是那些需要预装入注射器的药品。在长达7个月的时间里,辉瑞只是含糊地表示,公司的生产遭遇了挫折,每封信都表示下批出货日期要延后。尽管1月到3月,辉瑞关闭了麦克弗森工厂对设施进行升级维修,却也并没起到什么效果。 注射麻醉剂的短缺情况也极为严重,尤其是辉瑞几乎控制了整个注射麻醉剂市场。由于阿片类药物属于管制药品,因此它的供给是配额制的,配额由美国禁毒署决定。美国禁毒署每年会根据上年销量情况,向麻醉剂生产厂商严格分配阿片类药品的原料供给。也就是说,就算其他厂商有能力生产注射麻醉剂,以填补辉瑞留下的大坑,他们也拿不到生产这些麻醉剂的原材料。 2月下旬,包括美国卫生系统药师协会、美国临床肿瘤学协会在内的五个医疗组织联名向美国禁毒署请愿,要求调整配额以解决这一问题。(今年3月,辉瑞自愿放弃了部分配额,美国禁毒署将这些原材料分配给了其他厂家。) 辉瑞公司目前有300多种药品延迟交付。辉瑞表示,公司非常重视自己的责任,正在想办法积极解决问题。(在玛利亚风灾之后,辉瑞也加大了部分药品的产能,以弥补竞争对手的空缺。)不过辉瑞面临的挑战是十分巨大的,光是洛基山工厂每年生产的注射针剂就达5亿支,每天的产量都能装满20辆拖车。那里的工人要同时生产500余种不同的产品,这些药品有大瓶装的,有小瓶装的,也有预装在注射器里的;既有维生素K,也有抗新生儿凝血的药品,还有用于临终关怀的吗啡等等。 不过该工厂只有26条生产线,也就是说,每天生产线上生产的都可能是完全不同的产品。另外,每一条生产线要想生产某种药品,都得经过FDA的认证,这个审查过程也相当耗时耗力。要生产某种药品,必须提前几周做好排产,当然,某种药品的生产计划也可能因为任何不可预见的因素而被取消——比如下大雪、工人生病、零部件未按时到达工厂等等。 如果再算上测试和各种文件手续,一批产品可能需要三到六周才能离开工厂。每一批次的产品在生产环节中都会生成200页到400页不等的报告。当然,这些手续也算不上什么技术难题。对于这些需要直接注射到病人血管的药品来说,如何保持无菌的生产环境,才是最大的挑战。 |

After Hurricane Maria decimated Puerto Rico’s power grid in September, a cascade of problems for the health system followed—not just on the island, but across the United States. What’s more, it caught everybody off guard. Puerto Rico is home to a significant share of drug manufacturing and much of the nation’s production of saline solution, a central component to hospital care. “More and more, we’re hearing about shortages where there aren’t natural substitutions—or where the identification of substitutions is harder—and that’s leading to cascading shortages,” says an official in the office of the Assistant Secretary for Preparedness and Response at the Department of Health and Human Services. Erin Fox, a drug shortage expert who runs the University of Utah’s shortage list, says that after Hurricane Maria when people couldn’t get small bags of saline, there was a run on large bags, then syringes, vials, and sterile water. That natural catastrophe landed in the middle of Pfizer’s man-made one. In spring of 2017, Pfizer began sending “Dear Customer” letters, warning of anticipated product shortages—largely owing to issues at the McPherson facility—every few months. Particularly grave were the issues surrounding syringes prefilled with drugs. Over a seven-month span, the company relayed vague news of additional setbacks in production, with each notification pushing back the arrival of the next shipment. (It didn’t help that the company closed the McPherson plant from January through March to upgrade the facility and make repairs.) Injectable narcotics, in particular, were in desperately short supply—a function of not only the dysfunction at McPherson but also of Pfizer’s near-complete grip on the market. Because these opioids are controlled substances, they are subject to a quota managed by the Drug Enforcement Administration. The agency restricts the amount of the core ingredient that is available each year, and it strictly allocates that supply to manufacturers based on past sales. What this meant was that, even if other companies had the capacity to produce the narcotics and fill the void left by Pfizer, they couldn’t get the raw material to make them. In late February, five medical groups, from the American Society of Health-?System Pharmacists to the American Society of Clinical Oncology, petitioned the DEA to adjust the quota in order to address the problem. (In March, Pfizer surrendered a portion of its allotment, which the DEA reallocated to other suppliers.) Pfizer, whose list of drug back orders is well over 300 items long, says it takes its responsibility seriously and that it’s working feverishly to resolve its supply issues. (After Hurricane Maria, the company also stepped up production of certain drugs to make up for competitors’ shortages.) The challenge is substantial. The Rocky Mount facility, for example, makes up to a half-billion sterile injectables each year, enough to fill 20 semitrailers every day. Workers there make 500 different products, fitted into syringes, vials, and ampoules. They span a human life, from the vitamin K used to prevent blood clotting in new babies to the morphine used to ease the pain of terminal illness. The plant, though, has only 26 manufacturing lines, meaning that any given line is likely to be running something different every day. Each line, moreover, has to be FDA-?qualified for the drugs made on it, a costly and lengthy vetting process. Schedules are typically planned weeks in advance and can be scuttled for any number of unforeseen events, from a snow day to a worker’s illness to components that don’t arrive at the factory on time. Because of the testing and paperwork involved, it takes batches three to six weeks to leave the factory. And each batch generates a 200- to 400-page stack of paper that documents the process. These, of course, are merely logistical wrinkles. Achieving a sterile environment—essential for medicines that are shot directly into the bloodstream—is the true challenge. |

|

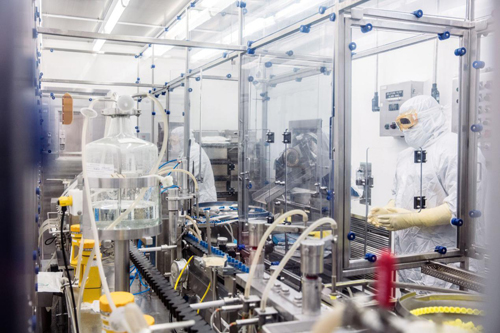

为了不扰乱气流,在无菌环境中工作的员工一举一动都要异常缓慢和小心,他们的双手总是向上举着,摆出类似投降的姿式。他们周身上下都穿着白色的无菌服,在进入无菌环境工作之前,他们得先花几个月的时间完全掌握穿脱无菌隔离服的技术。(在上世纪70年代,从事这项工作的工人一般穿着隔离罩衫,戴着一顶纸帽子。)在进入无菌环境前,他们要先进入一个玻璃隔间,对身上穿的隔离服用消毒剂进行灭菌处理。隔着窗子看着他们,感觉有点像在观摩宇航员登月。工人们埋头苦干,来自外部世界的需求也从来不会停止。经理们有时候会在生产线上方贴几张婴儿的照片,以增加工人的紧迫感和责任感。 辉瑞全球供应总裁兼常务副总裁克里斯汀·伦德-尤根森表示,辉瑞正在尽全力满足市场需求。“我们不希望再发生严重的供给短缺,现在我们的目标非常明确。”辉瑞的经理们现在跟医院的医生们差不多,基本上每周都要开会讨论药品短缺情况,然后评估哪些药品在医疗上是最急需和最重要的,然后优先排产。 对于医疗一线来说,药品短缺的代价和影响无疑是巨大的。要想给短缺药品找出足够的替代药,药师们不仅耗时耗力,还得有一定的创造性才行。首先他们得发现哪些药品和耗材已经短缺了,然后他们要找到几种替代品,在别的医院下手前抢先订购,然后再对现有药品进行“优化组合”,分派到一线。最后还有一项艰巨的任务,就是如何把这些变化传达给一线的医护人员。 在与死神赛跑的急救室,医生们能不能及时找到替代药物,能不能正确地使用它们,有时是关乎病人生死的。美国安全药物实践研究所收集的大量案例表明,药品短缺经常会导致医疗事故的发生。2017年一项对300余名医疗业者的调查显示,在此前6个月的近百起出错事件中,很多错误都是由于医生将药品开错了剂量或浓度而导致的。 |

So as not to disturb the airflow, employees in aseptic spaces move slowly and deliberately, their arms raised as if in an act of surrender. They are fully covered, dressed in white boxy bunny suits that they’re allowed to don only after months of mastering the gowning technique. (In the 1970s, workers suited up for the job in a smock and paper cap.) They are separated from the slightly less sterile areas by windows streaked with disinfectant. Watching workers ploddingly unwrap instruments and tend to their machinery is like watching a lunar landing. In the midst of this logistical labyrinth come the never-ending demands of the world outside. To instill a sense of urgency, managers sometimes post photos of babies above the manufacturing lines. Pfizer is doing its best to meet that demand, says Kirsten Lund-Jurgensen, its president of global supply and an executive VP. “We don’t ever want to have significant supply shortages again,” she says. “The mission is really clear to us.” That means Pfizer managers now have routines much like those of hospital doctors: They huddle every week, she says, to assess the shortages and to prioritize drugs considered “medically necessary” and “medically significant.” Both the costs and effects of these drug droughts, it goes without saying, are also medically significant. Even to cobble together a B-list of drugs and medical supplies requires an inordinate amount of pharmacist hours and some creativity. The goose chase involves calling around for scarce medicines and supplies, identifying multiple alternatives and ordering them before others do, and optimizing available drugs by compounding and repackaging them on site. Then there’s the herculean task of communicating the changes to the hospital staff. And in the melee of ERs, the race to find alternative medications and use them appropriately can sometimes lead to mistakes. The Institute for Safe Medication Practices has amassed a great deal of anecdotal evidence that shortages result in medical error. An October 2017 survey of some 300 practitioners revealed nearly 100 instances over the previous six months when mistakes were made—many of them involving administering medicines in incorrect doses or concentrations. |

|

另外,美国医疗系统的防灾能力也令人担忧。佛罗里达州斯图尔特市马医医疗系统助理副总裁兼首席药品官戴夫·哈罗指出:“今年的飓风季节又快到了,留给我们的时间已经不多了。如果不加以解决,到时急诊室将迎来一场灾难。”据哈罗统计,他的医院目前有275种药品短缺。马丁医疗系统离特朗普的海湖庄园近在咫尺,然而面对供给短缺,这个总统家门口的医院也同样无能为力。 值得一提的是,本文中的多位受访者(其中并无辉瑞公司的员工)都认为,美国对药品的质量控制似乎有些矫枉过正,似乎应该稍微给药厂松松绑了。以前在审查没有那么严格的时候,供应商们总能拿到他们需要的药品,那时没有什么自动视觉检测设备,可是也没听说有谁被不合格的药品治死了。 克里夫兰门诊的药品短缺问题专家克里斯·斯奈德认为:“大家都想生产出更好的甚至是完美的产品,这种想法可以理解。可是如果医院无法及时获得某些药品,病人的生命就会受到威胁。因此,我们应该有此一问:‘在我们治疗病人时没有药品了怎么办?所有其他医院是怎样应对这个问题的?’没有人想看看幕后的深层问题。” 还有人认为,监管上的矫枉过正已经引发了危险的后果。生产无菌药的工厂被迫停产后(当然,FDA严正指出,这并非是他们下达的命令),监管机构相当于将一个不可能完成的任务丢给了医院——难道要让他们自己在无菌环境中合成药物吗? “所有这些医院是怎样应对这个问题的?没人想看看幕后的深层问题。” ——克里斯·斯奈德:克里夫兰门诊药品短缺问题专家 在《财富》采访克里夫兰门诊时,斯奈德表示,他近来一直都在为药品短缺问题烦恼,有时就连睡觉也会梦到这个问题。基本上他每天都会在地下室里打电话给各个科室的医生,让他们检查重要短缺药品的库存。最近他正在焦急地等待一批氯化钾到货,据供应商说,这批氯化钾几周前就在波多黎各装船了,预计会在迈阿密卸货,但不知道为什么,直到现在还没到货。“就算船走走停停的,从劳德戴尔堡到尤卡坦半岛,开一周也应该到了吧!”斯奈德无奈地对其他药师道:“我也得去度度假了。” 如果这批氯化钾再不马上到货,药房工作人员只能改变现有存货的浓度。这样一来,IT团队就得更改整个医院几乎所有病人的电子病历。此话一出,IT团队传来一片哀怨之声。除了氯化钾之外,这家医院其他短缺的药物也有不少。当天斯奈德还得处理一批注射器的召回,据美国疾控中心说,这批注射器可能存在细菌感染。 然而斯奈德对于这种事却显得很从容,虽然药品生产商给他添了这么多麻烦,但他似乎毫无愤怒之意。斯奈德坦承,这种事早已成了他的日常。最后他无奈地说道:“不然我们还有什么选择呢?”(365娱乐场) 本文原载于2018年6月1日刊的《财富》杂志。 译者:朴成奎 ? |

Another concern is disaster preparedness. “The clock is ticking as we approach hurricane season,” says Dave Harlow, assistant vice president and chief pharmacy officer at Martin Health System in -Stuart, Fla. “The situation is an emer?gency waiting to be a disaster.” Harlow is currently managing 275 shortages. He notes that Martin is within an ambulance-drive range from Mar-a-Lago and that when it comes to the nation’s drug shortages, they don’t discriminate. A number of people interviewed for this story—none who work at Pfizer, notably—suggested that the march of progress in quality control has gone too far, or at least that it should be tempered a bit. Back in a simpler, less scrutinized era, providers got the drugs they needed, and no one seemed to suffer the effects of a drug not passed through automated visual inspection equipment. “In efforts to make better, even potentially perfect products, we may lose sight that being without some of these medications could be life threatening,” says Chris Snyder, the Cleveland Clinic shortage specialist. “We need to ask, ‘What does this look like when we’re taking care of patients? How are all these hospitals dealing with it?’ Nobody wants to look behind that curtain.” Others argue the level of regulatory nitpicking has backfired in a dangerous way. By stalling production at factories that make sterile drugs—and the FDA pointedly denies that it has—the regulator has pushed hospitals into a task many of them aren’t equipped to handle: compounding drugs in a sterile environment. “How are all these hospitals dealing with it? Nobody wants to look behind that curtain” ——Chris Snyder: Drug Shortages Specialist, Cleveland Clinic On Fortune’s visit to the Cleveland Clinic, Snyder channels his laid-back dude. Tall and jolly by nature, the Ohio native says he has been so preoccupied by drug shortages of late that he sometimes dreams about them. On what he calls a typical day, Snyder is in his basement cubicle calling around to colleagues across the system to check on their inventories of essential, short-supply drugs. He is anxiously awaiting a shipment of potassium chloride, which its supplier says was loaded on a boat in Puerto Rico weeks ago, bound, he thought, for Miami. It’s hard to fathom that it hasn’t arrived. “You can get from Fort Lauderdale to the Yucatán peninsula in a week—with stops all along the way,” Snyder quips to the other pharmacists. “I need to go on vacation.” If it doesn’t turn up soon, the pharmacy staff will have to change concentrations of the chemical solution—a step that will force the hospital’s IT team to reconfigure the systemwide electronic medical records. The prospect elicits audible groans from the team. Snyder is also managing other shortages that day, including a mass recall of syringes—the CDC had linked them to bacterial contamination. He seems to take it all in stride, and as he ticks through multiple issues at drug manufacturers, what is most striking is his lack of outrage. Snyder admits it has become business as usual. Then, he asks with resignation, “What choice do we have?” This article originally appeared in the June 1, 2018 issue of Fortune. |

最新文章