|

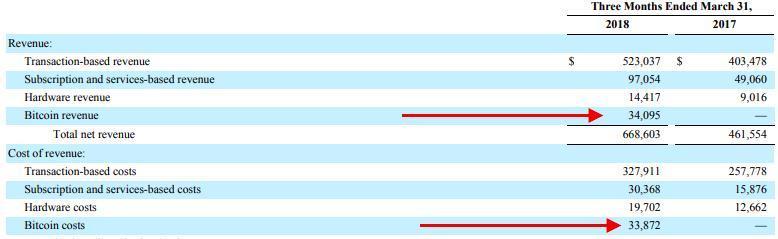

上周三下午,美国移动支付公司Square在季报中披露了其比特币业务的经营状况,情况可以说喜忧参半。可喜的是,公司上季度从比特币相关业务中收入3400万美元。可忧的是,Square公司一开始收购比特币时也花了差不多同样的钱,收支相抵,所差无几。 Square公司最成熟的业务是提供给小商户的信用卡收款机。今年1月,在经过短暂测试后,该公司在其点对点支付业务Square Cash中推出了比特币的购币功能。 该业务一经推出就吸引了不少人的关注,比特币业务收入迅速攀升到了该公司总收入的近5%。不过最近的成绩表明,这项业务在早期阶段或许很难实现营利。先让我们看看该公司的收入构成: |

Square shed light on the state of its fledgling Bitcoin business in its earnings report last?Wednesday afternoon. The good news for the payment company is that it pulled in $34 million of Bitcoin-related revenue last quarter—the bad news is that Square spent nearly as much to acquire Bitcoin in the first place. Square, which is best known for its dongle that helps small merchants accept credit cards, began officially offering Bitcoin purchases within its peer-to-peer payment service, Square Cash, in January, following a brief test program. The Bitcoin trading service appears to be gaining some traction, accounting for nearly 5% of Square’s overall revenue. But the results suggest the company may be struggling to make a profit in the venture’s early days. Here’s a breakdown from the company’s income statement: |

|

光看收入一项,Square公司到目前为止从比特币业务中获取的收入极其微薄,通过销售其购入的比特币获得的收入仅有22.3万元,收益比仅有0.66%。 与此同时,Square很有可能实际上已经在比特币业务上亏了一些钱。从季报上看,今年第一季度结束时,Square持有的比特币的价值已经从2017年末的30万美元下跌到了20万美元。Square公司承认了其比特币业务稍有亏损,不过损失额度不值得一提。该公司在季报中写道:“今年前三个月(截止至3月31日),比特币业务的亏损是微不足道的。” Square的比特币业务所面临的艰难处境,也非是因为它在2017年年末开始的“比特币狂潮”中高位接盘所致,跟普通散户所犯的错误并无二致。Square公司在其季报中指出:“公司从公开的数字加密货币交易所和其他客户处购入了比特币。” 季报中所指的数字加密货币交易所包括美国最大的交易所Coinbase,也包括Kraken、Circle等海外数字加密货币交易机构。 从去年年底开始,比特币的币值横遭腰斩,损失五成以上。而Square也正是在价格高位上入手的比特币。 在推出比特币业务之后,Square的股价曾一度提振,然而随着比特币币值一路下跌,它在投资者眼中的光环也迅速褪去了。上周一,一位知名的做空投资人公开嘲笑了Square的战略,大意是说“华尔街的让搞比特币的忽悠瘸了”。Square的股价也因此言论应声下跌了3.8%。 由于远期收益指标低于预期,在上周三的盘后交易中,Square的股价再次下跌超过6%。今年一季度,Square的每股收益为6美分。 现在就给Square比特币业务的前景盖棺定论似乎还为时过早,毕竟数字加密货币交易市场仍处于襁褓阶段。此外,包括知名股票交易应用Robinhood在内的一些大牌金融机构也正在采取类似动作进军数字加密货币市场。(365娱乐场) 译者:Min

|

Looking at revenue alone, Square appears to have made only a tiny return on Bitcoin so far, making just $223,000 more from selling Bitcoin than it paid to buy the cryptocurrency—a return of only 0.66%. But Square may actually have lost money on its cryptocurrency business so far. The value Square recorded for its Bitcoin holdings was only $200,000 at the end of the first quarter, down from the $300,000 they were worth at the end of 2017, according to the company’s quarterly report. Square acknowledged that it had taken a small hit on Bitcoin, though not enough to merit recording an impairment charge: “Losses on Bitcoin for the three months ended March 31, 2018 were insignificant,” the company wrote in the report. Square’s difficulties may stem in part from an ongoing slump in Bitcoin prices since the boom of late 2017, and in its strategy for acquiring it—which is similar to how the average person would buy Bitcoin. As Square explains in the earnings report, the “company purchases Bitcoin from public cryptocurrency exchanges or from customers.” Public exchanges for buying cryptocurrency include Coinbase, the largest U.S. exchange, as well as Kraken, Circle and other foreign exchanges. Bitcoin prices have fallen more than 50% since the end of last year, around the same time Square started buying the cryptocurrency in earnest. While Square’s stock price initially rose on news of its Bitcoin business, the sheen among investors may have worn off. On last?Monday, the stock briefly fell 3.8% after a prominent short-seller belittled the strategy as “Wall Street drunk on Bitcoin nonsense.” In after hours trading on last?Wednesday, Square shares were down over 6% in response to future earnings guidance that fell lower than expected. In the first quarter, the company posted earnings of 6 cents a share. It’s likely too soon, however, to gauge the overall prospects of Square’s foray into Bitcoin. The market is still nascent in many respects and other prominent financial brands, including the popular millennial stock-buying app Robinhood, are making similar moves into cryptocurrency.

|

最新文章